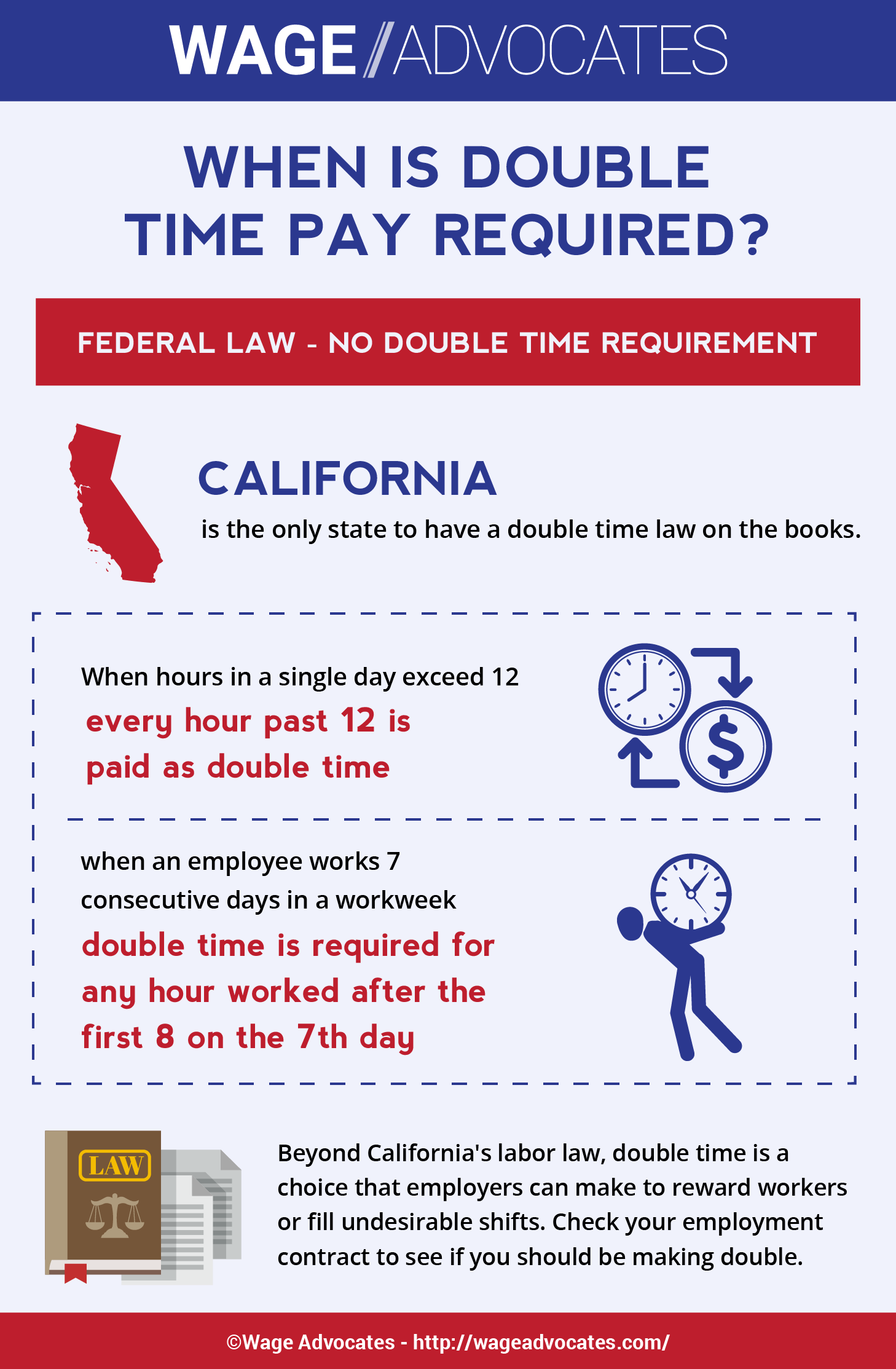

Overtime Pay Laws by State - 2020 Guide | QuickBooks This regulation will become important later on when we want to figure out how to properly calculate double time inCalifornia. The New York overtime pay laws have a provision to help you fight for your rights. If you earned overtime or any other premium pay during the last week you worked, you will receive pay for these exceptions two weeks after you stop working. In general, holidays are considered regular workdays and employees receive their normal pay for time worked. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 99 Park Avenue, Suite 1510 *Seasonal Hourly employees may be eligible for Holiday Pay although they are not subject to Civil Service Attendance Rules. On the 5th and final day, they work 14 hours. That said, both federal and state law requires most employers, but not all, to pay overtime to employees whose hours meet the criteria. NOTE:Employees in the Administrative, Operational or Institutional Services Units, Division of Military and Naval Affairs Unit or Management/Confidential (below grade 623) who are called into work on a holiday will receive compensation for at least 1/2 day of salary at straight time (or 1/2 day of compensatory time off). To finish the picture, well need to calculate Lucys two hours of double time at a rate of $20 per hour. Most workers in the United States are entitled toovertime pay, which should kick inafter you clock in more than 40 hours worked in a given week. Bantle & Levy can help you recover your unpaid overtime pay. In addition, many employers in states without double-time laws choose to observe rules for double time within their organization to compensate workers for their willingness to put in long hours or to fill undesirable shifts. On the other hand, if you earn less than $684 per week and your duties are in accordance with FLSA specifications, you will be a non-exempt employee. If your employer has declared your position exempt from overtime, even though you do not qualify as exempt under the state's regulations, they are violating New York overtime laws. When an employee works more than 12 hours in one shift, the time beyond the initial 12 hours is considered double time. Returning for its seventh consecutive year, New York City's Pride March kicks off Sunday. Frequency of Pay Frequently Asked Questions. Building 12, Room 266B Albany, NY 12226, This page is available in other languages, Employers authorized to pay manual employees on a biweekly basis, Worker Adjustment and Retraining Notification (WARN). From federal regulations to exemptions, you need to know as much about New York overtime pay laws as possible. . The parade, slated to begin at 12 p.m. (ET) in Manhattan, takes place during LGBTQ Pride Month along with . Double time is a type of overtime pay rate where the employer pays an employee twice their normal rate. What France. That state is California. Yes, the overtime pay laws in New York require your employers to pay overtime. Most workers have two basic options, either contact the Department of Labor to initiate a claim orfile a wage violation lawsuitagainst their employer. Mandatory Overtime: What You Need to Know About the Laws in - Namely In leap years, the calculation of your bi-weekly gross is based on 366 days instead of regular 365 days. The yearly earnings estimate of $29,536.00 is based on 52 standard 40-hour work weeks. Hence, we need to look at the total hours worked and subtract the hours already being classified as double-time and daily overtime hours: 69 hours (4 double-time hours + 17 daily overtime hours) = 48 hours, 48 hours 40 regular hours = 8 weekly overtime hours. You must have JavaScript enabled to use this form. NEWSMAX Saturday, June 24, 2023 - Facebook This Google translation feature is provided for informational purposes only. The overtime pay laws in New York allow you to recover up to double your unpaid overtime wages going back two to three years before reclassification. Incorporate for FREE + hire a lawyer with up to 40% off*. For more detailed information, including which employees are covered by this law, please seeFrequency of Pay Frequently Asked Questions. Is any of our data outdated or broken? In this case, thats one hour of double time. Pay It Off - HRA - NYC.gov Who Pays for the Missing Titanic Sub Search and Rescue Mission? - The

For annual educational paraprofessionals there is no payroll lag. Here are a few examples to help you understand Californias double time rules, which can get tricky. Get the latest headlines: http://newsmax.com. The problem is that, while you worked seven consecutive days, one of those days fell outside a single workweek. This is known as "double-time" pay. For most City agencies, your leave balances are indicated on your pay statement. Sometimes, prior to hiring, an employee will negotiate for a certain number of paid vacation days. However, the minimum is $13.20 for the remainder of the NY state from December 31, 2021, through December 30, 2022. Overtime pay is 1 1/2 times you regular pay for all hours above a 40 hour work week (44 hours for residential employees). By The New York Times The R.M.S. What about vacation pay during a holiday? Tell us more about you to receive content related to your area or interests. This means for every hour of overtime, an employee is paidtwo times what the employee normally earns. The Titan was designed to have an oxygen supply of as much as 96 hours in . If you suspect you were fired illegally, consult an employee rights lawyer immediately. Here is a sample overtime pay calculation. Employers who meet certain criteria may apply for permission to pay manual workers less frequently than weekly. You will need to exceed the weekly threshold of your regular work hours for working on weekends to count as overtime pay. As an incentive, some employers may opt to offer double-time to employees working on holidays, meaning that their regular rate is multiplied by two. For the first 5 days, they work 9 hours per day. You get overtime pay only if your work hours exceed their weekly threshold of 40 hours on holiday. The New York State Office of the State Comptroller's website is provided in English. The next holiday is just around the corner, and for small business owners and employees, holiday pay policy can be confusing. It appears that your web browser does not support JavaScript, or you have temporarily disabled scripting. To arrive at Lucys overtime wage, all we need to do is multiply her regular rate of pay by one-and-a-half. What Is Double Time Pay & When Is It Mandatory? To arrive at your double-time rate, just double your regular rate (multiply by two. ) You might see double-time incentives offered for work on federal holidays, for overnight shifts, or, in rare cases, on weekends. However, the "Google Translate" option may help you to read it in other languages. ExakTime has strategic partnerships with key software providers, ensuring a smooth integration of our program with your accounting system and other workforce solutions. This is one example of why it's so important to know about the employment laws and the wage-and-hour laws between the states. Some employees, however, are entitled tomore. Pyramiding of Overtime and Double-time hours is not permitted by California law. Those wages include regular earnings, shift differential pay, location pay, longevity payments, pre-shift briefing pay and top-of-pay-grade bonus.1. Due to the lag, you will receive pay two or three weeks after you stop working. You must spend no more then 20% of your time doing other activities (or 40% in a retail environment), and your job should be a salaried position. $400 Straight Time 150 Overtime $550 Total Pay What does "regular rate" of pay mean? Yes. Mr. Biden agreed to plead guilty to misdemeanor counts of failing to pay his 2017 and 2018 taxes on time and be sentenced to . Generally, hourly employees who earn under $455 per week ($23,660 per year) and who work in a non-exempt industry are eligible to receive overtime pay. 20 hours (first four days) + 14 (last day) 2 double-time hours + 4 overtime hours = 28 hours, (28 hours) X $15/hour) = $420 + (2 hours X $15/hour X 2) = $60 + (4 hours X $15/hour X 1.5) = $90 = $570. To add this, click on the "Select Leave" drop down and select . The main point is to pick something and stick to it, unless there are extenuating circumstances. Overtime laws in New York and nationally are designed to prevent workers from being exploited by their employers, with hourly wage earners (particularly those in blue-collar indistries) being the primarily protected group. List of employers authorized to pay manual employees in New York State on a biweekly basis pursuant to New York State Labor Law Section 191.1a(ii). In addition to the federal holidays listed above, other paid holidays might also include: Ultimately, paid holidays are up to each employer to define. There is no requirement in New York overtime laws for employers to pay double time for any number of hours worked. If you are paid on an hourly or per diem basis, your pay reflects days worked up to and including two Saturdays before pay day, constituting a two-week lag. Some union contracts provide for a double-time pay rate, especially on really long days of work, but youll have to check with your own contract to know if double-time (in addition to overtime) applies in your case. Additionally, when a California employee works on seven consecutive days in a workweekregardless of the total number of hours workedthey must be paid double time for any hours worked beyond eight hours on the seventh day. The laws pertaining to overtime pay may change from state to state. Understanding Your Bill - Help Executive, administrative or professional workers who earn salaries are often exempt from overtime laws, as well as workers who earn commissions. Your annual salary remains the same whether it is a leap year or not. All Rights Reserved. Workers are exempted from overtime pay if they work 80% or more of the time doing administrative, professional, or outside sales duties. Google Translate cannot translate all types of documents, and it may not give you an exact translation all the time. For more information about overtime requirements, visit the U.S. Department of Labor website or ask a lawyer. The FLSA does not require overtime pay for work on Saturdays . Do not withhold contributions for any overtime amounts beyond the limit. This constitutes a one-week lag. Top 5 States With the Best Overtime Laws for Workers By the time he got out of Queens, he looked down at . It is only considered overtime if it is paid for additional hours worked beyond ones regular schedule and at a greater rate than ones regular rate of pay. The armed standoff on the road to Moscow, brief as it was, represented the most dramatic struggle for power in Russia since the 1991 failed hard-liner coup against Mikhail Gorbachev and the 1993 . Paychecks are mailed directly to the employee's home on a semi-monthly schedule. Refer to the current appropriate contract for more information. If you are past your 40-hour work week and working on weekends, it should qualify as overtime pay. Because of the nature of the work environment and working hours required by certain careers, there are a wide variety of specific exemptions to New York overtime eligibility. A New York City government website says there were more than 6,000 active public pay phones when LinkNYC first began its work in 2014, a number that quickly dwindled. However, the overtime cap will not apply if the Fair Labor Standards Act (FLSA) mandates payment for overtime worked or if your agency has been granted an overtime waiver by the Office of Labor Relations. Therefore, you should convey rules and policies clearly to your team, and be certain you can track their hours accurately and pay in accordance with federal and state law. For example, a worker puts in two 13-hour shifts during the week and no more. In this case, thats four hours of regular overtime. Just like working on weekends, working on holidays wont qualify as overtime pay automatically. The real consideration, then, is whether or not you worked every day in one workweek. . If you arent required to pay it, you must decide when you will provide double-time pay. Under federal law, a holiday doesn't have a special designation for overtime pay, nor is working on a holiday considered overtime. The New York State Department of Labor manages wage and hour issues for New York. However, exceptions to your regular pay, including premium pay for overtime, shift differentials, or work on holidays during the second week of the pay period, were not reported until after your pay was calculated. Employees designated as Management/Confidential in a position allocated to Grade 23 or above, or in an unallocated position where the salary equates to Grade 23 or above, are ineligible for holiday pay. If your job falls under any of the four categories described above, then you are not covered by federal or New York unemployment regulations and your employer is not required to pay you an overtime premium. Help us keep Minimum-Wage.org up-to-date! Trump Steers Campaign Donations Into PAC That - The New York Times *The City's fiscal year begins on July 1 of the previous calendar year and ends on June 30 of the current calendar year. Please note: The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System. The most recent overtime caps are as follows: There are separate payrolls that serve six groups of employees of the Department of Education: Pedagogues, covered by the United Federation of Teachers (UFT) and Council of Supervisors and Administrators (CSA), as well as pedagogic managers, including Superintendents and Deputy Superintendents, are paid on a semi-monthly basis. However, there are a few exceptions. Under a deal hashed out over several months by Hunter Biden's legal team and federal prosecutors, he will plead guilty to misdemeanor counts of failing to pay his 2017 and 2018 taxes on time and . Second, your W-2 shows accumulated earnings from the full pay periods that fall in the calendar year. In addition to weekly overtime pay, California also requires that eligible (or non-exempt) employees get paid overtime for all hours worked over 8 in a single workday. As an employee, overtime is your right whether you work for the government or a private company. Tier 6 PFRS Members: The limit is 15 percent of a members wages, as determined at the beginning of each calendar year. Even if you arent required to pay double time, you may choose to do so as an incentive for hours worked over a certain number, for hours after a number of consecutive shifts, or for holidays. Thus, you will be entitled to overtime pay. While a majority of government offices are closed on these days, small business owners and other private employers have the option of staying open. To learn more about Washington's mandatory overtime . Note that the sample calculations above are pre-tax and are examples only. If anemployee is entitled to vacation pay, it will be based on an agreement between the employerand the employee. Add up all of Lucys compensation and she should be paid $180 for her single twelve-hour day. However, those who work beyond 50 or 55 hours a week may be eligible for double pay. Your job must be salaried to fulfill the requirements, and you must spend no more then 20% of your time doing activities that do not fit in the categories described above (or 40% in a retail environment). So, your recovery will be considered income and be taxed accordingly. Published June 20, 2023 Updated June 22, 2023, 1:58 p.m. To calculate an employee's overtime pay for time and a half, multiply their regular rate by 1.5. Practical nurses and paralegals, who would otherwise fall under the exempted category, are also specifically protected by overtime law as these particular professionals often endure long hours of work, and may be exploited or overworked by their employers otherwise.